Unlock your money mojo

Do your financial dreams feel just a little out of reach—like that last biscuit at the office party? Setting clear, strategic financial goals could be the roadmap you need to turn “someday” into “right now.” Whether it’s a short-term goal like a holiday fund or a long-term goal like retiring before you grow a grey beard, each milestone helps you unlock your financial superpowers.

Here’s why breaking your goals into short-, medium-, and long-term buckets isn’t just helpful—it’s essential.

1. 🎯 Direction and Purpose

Without a goal, your money wanders toward distractions—likely another coffee. Goals act like a roadmap, focusing your resources.

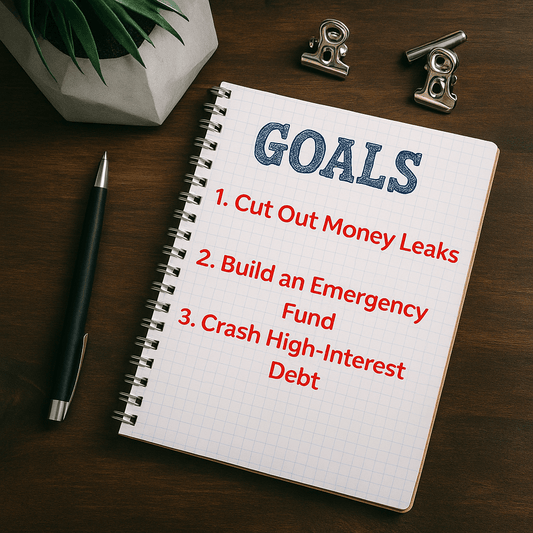

💡 Quick Tip: Write down your top 3 financial goals and break each into bite-sized steps.

2. 🚀 Motivation Booster

There’s something wildly satisfying about hitting a goal—no matter how small. Paying off that lingering credit card or reaching your rainy-day savings target gives you momentum to keep going.

💡 Quick Tip: Automate tiny savings deposits or set fun reminders (we suggest naming them things like “Treat Future You”) to keep goals top of mind.

3. 🧠 Smarter Decision-Making

Impulse buys get a lot less tempting when you’ve got a clear goal. Should you splurge on that shiny new gadget, another home decor item, or save for a dream trip? Goals help filter out the fluff.

💡 Quick Tip: Ask yourself, “Does this purchase bring me closer to my goals?” If not, maybe it’s a no.

4. 🧘♀️ Less Financial Stress

Nothing soothes money anxiety like a plan. Even just knowing where your cash should go can relieve the stress of uncertainty.

💡 Quick Tip: Start an emergency fund—it’s the financial equivalent of having a spare umbrella.

5. 📈 Measurable Progress

Goals let you track your progress and actually see results. More importantly? They give you a reason to celebrate every little win.

💡 Quick Tip: Use a budgeting app (or a good ol’ spreadsheet) to keep tabs on your progress, especially your savings goals.

🧩 Breaking It Down: Short, Medium, and Long-Term Goals

Short-Term Goals (Next 12 Months)

Small wins, big impact. These get you moving and help form good money habits.

- Examples: Start an emergency fund, pay off small debts.

- Action Tip: Set up automated weekly savings to get that momentum going.

Medium-Term Goals (1–5 Years)

These goals bridge today and the not-so-distant future—think bigger purchases or career changes.

- Examples: Save for a house deposit, launch a side hustle.

- Action Tip: Create dedicated savings accounts for each goal to stay laser-focused.

RELATED: Best Savings Accounts (UK, August 2025): Why You Need One

Long-Term Goals (5+ Years)

These are your “big life dreams”—like retirement, owning a home, or sending the kids off to uni debt-free.

- Examples: Build a retirement nest egg, pay off your mortgage.

- Action Tip: Meet with a financial advisor to map out long-term investment strategies.

5. Visible Progress

Goals let you track wins and stay accountable.

Quick Tip: Use an app or spreadsheet to monitor progress and celebrate each step forward.

Goal Breakdown by Timeline

| Timeline | Examples | Action Tip |

|---|---|---|

| Short-Term (0–12 mo) | Emergency fund, small debts | Automate weekly savings |

| Medium-Term (1–5 yr) | House deposit, side hustle launch | Create separate savings pots |

| Long-Term (5+ yr) | Retirement, mortgage-free life | Consult a financial advisor |

⚖️ Achieve Balance and Feel Empowered

Strategic goal setting isn’t about being rigid—it’s about balance. By categorising your goals, you stay focused and flexible. Think of it as a financial yoga pose: disciplined, but with room to bend.

“Set goals. Start small. Think big. Adjust often.”

Financial freedom isn’t just a dream—it’s a plan with a to-do list. And you’ve got the pen.

Conclusion: Take That First (Financial) Step

Strategic financial goals are the GPS for your money journey. Whether you’re budgeting for a weekend getaway or mapping out early retirement, short-, medium-, and long-term goals keep you grounded and on track.

So grab a notebook (or your Notes app), dream big, and start mapping it out. The future is waiting—and it’s looking financially fabulous.