We all have dreams – owning a home, traveling the world, starting a business, or simply living a debt-free life. While daydreaming about these goals is enjoyable, turning them into reality requires more than just imagination. It takes action, planning, and sometimes, a bit of clever budgeting.

In this article, we'll explore how financial planning can transform your dreams into achievable goals and offer you a free automated budgeting template to get you started on your journey.

The Power of Financial Planning

Financial planning is like a roadmap for your dreams. Without a plan, you might find yourself wandering aimlessly, hoping to stumble upon your goals. With a plan, you have clear directions and a better chance of reaching your destination. But don't just take our word for it; let's break down why financial planning is so powerful.

Clarity and Focus

One of the greatest benefits of financial planning is that it brings clarity to your financial situation. By understanding where your money is going, you can make informed decisions about where it should be going. This clarity helps you focus on what's important, allowing you to prioritize your spending and saving.

Imagine trying to drive to an unfamiliar place without a map or GPS. You'd likely get lost, waste time, and feel frustrated. Financial planning acts as your financial GPS, guiding you towards your goals and helping you avoid unnecessary detours.

Motivation and Accountability

When you have a financial plan, you set specific goals and create a timeline for achieving them. This structure provides motivation and accountability. It’s much easier to stay on track when you have a clear plan and can see the progress you’re making.

Think of it like training for a marathon. You wouldn’t just lace up your sneakers and start running aimlessly. You’d follow a training plan, track your progress, and celebrate milestones along the way. Financial planning works in the same way, keeping you motivated and focused.

The Joy of Budgeting

Now, let's talk about budgeting. Yes, we know budgeting often gets a bad rap. It’s often seen as restrictive or boring. But in reality, budgeting is empowering and liberating. It gives you control over your finances and helps you make intentional choices about your money.

Turning Dreams into Reality

Now that you have a roadmap and the tools to stay on track, let’s talk about how to turn your dreams into reality through financial planning.

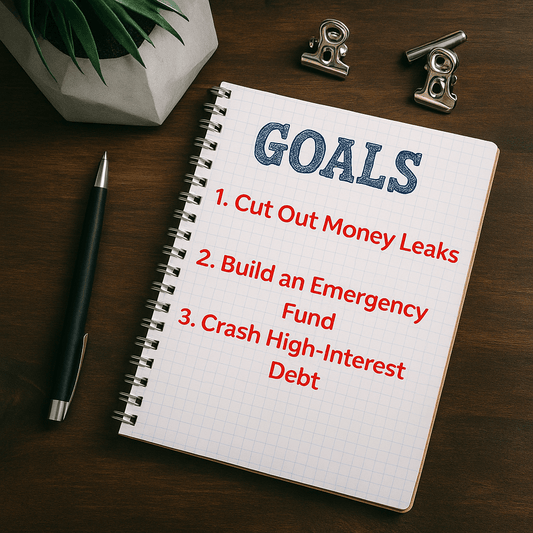

Set Clear Goals

Start by setting clear, specific goals. Instead of saying, "I want to save money," set a goal like, "I want to save £5,000 for a vacation next year." Specific goals are easier to plan for and achieve.

Break It Down

Once you have your goals, break them down into smaller, manageable steps. For example, if your goal is to save £5,000 in a year, break it down to saving approximately £417 per month. Smaller steps are less overwhelming and make it easier to stay on track.

Monitor and Adjust

Regularly review your financial plan and budget to ensure you're on track. Life is unpredictable, and your financial situation may change. Be flexible and willing to adjust your plan as needed. The automated budgeting template can help with this by providing real-time updates on your financial status.

Celebrate Milestones

Don't forget to celebrate your milestones along the way. Achieving financial goals is hard work, and it’s important to recognize and celebrate your progress. Treat yourself to a small reward when you hit a milestone – just make sure it fits within your budget!

Conclusion

Dreams do come true through financial planning, and you don’t have to do it alone. With a clear plan, the right tools, and a bit of determination, you can achieve your financial goals and live the life you’ve always dreamed of.

To help you get started, download our free automated budgeting template. It’s designed to simplify the budgeting process and keep you on track with minimal effort. To download your free template and start your journey towards financial freedom today.

Remember, action is the key. As the mind creates a picture, all you have to do is act on what needs to be done. Happy planning!

By following these tips and using the free automated budgeting template, you'll be well on your way to achieving your financial goals. So go ahead, take the first step, and watch as your dreams turn into reality.